Éternelle question pour les marques intéressées par le mobile : vaut-il mieux avoir une app dédiée ou un site marchand optimisé pour les Smartphones et tablettes ? L’article rapporte un certain nombre d’expériences anglaises chiffrées et n’oublie pas de mentionner l’apparition des beacons dans les boutiques traditionnelles.

Apps falling behind mobile websites in rush to m-commerce

Wed, 14 May 2014 | By Jonathan Bacon

People are visiting retailers’ mobile websites more often but are more likely to buy through an app, so brands must ensure both are on a par.

The decision of some brands to focus on app development has been called into question by new research that shows that most smartphone users interact with retailers via mobile websites rather than via apps.

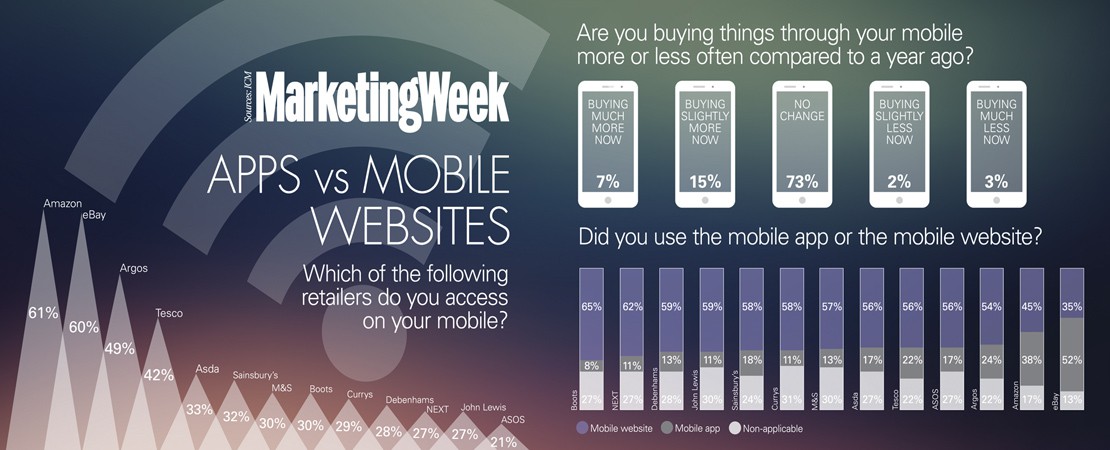

The study by ICM Research asked over 1,300 people if they had ever interacted with a sample of 13 retailers on their smartphones. Where people had visited the brands, mobile websites were the most commonly used option across 12 of the retailers, with eBay the only brand to receive more traffic via its mobile app.

Boots has the smallest proportion of app users at just 8 per cent of its smartphone user base, compared with 65 per cent who use its mobile website. Fashion retailer Next has the second-lowest proportion of app users at 11 per cent, with 62 per cent interacting via a mobile browser. By contrast, 52 per cent of eBay’s mobile users access the auction site via its app, compared with 35 per cent on its mobile website.

ICM associate director Jamie Belnikoff says he is surprised by the extent to which consumers are choosing mobile websites over brands’ dedicated apps. He notes that people browsing for products are more likely to visit mobile websites while brand-loyal customers tend to download apps with the intention of making purchases.

“The results show that brands shouldn’t just focus on their apps. They’ve got to make sure that their mobile websites are fully optimised for mobile shopping too,” says Belnikoff.

“But sales are much more likely to take place through a mobile app than through a mobile website, so the challenge for brands is encouraging people to use their apps rather than the mobile website.”

In general, Amazon and eBay are

the most popular retailers among mobile users, with about 60 per cent of all the people surveyed having accessed the sites on a mobile device either via a browser or an app. This puts the two ecommerce giants significantly ahead of the other 11 retailers considered in the research. Argos is the third-most popular brand with 49 per cent of people saying they have visited the retailer on their mobiles.

Amazon and eBay also receive the highest ratings for their mobile user experience. People were asked to score each retailer out of 10 and Amazon came top with a score of 7.8 while eBay was second on 7.6 and John Lewis third on 7.1.

Sarah Calcott, senior marketing director at eBay UK, says the company was quick to recognise the value of mobile following the launch of the iPhone in 2007. EBay has rolled out a series of innovations on smartphones, including a barcode scanner that enables people to search for products and prices and an integration with PayPal that allows shoppers to pay for items with one click. The company has also launched specific apps for the fashion and motor markets.

“We’re constantly looking to improve and provide buyers and sellers with the ability to easily browse, shop, sell and manage their eBay activity whenever and wherever they are,” says Calcott. “Last month, we made a series of changes to our apps, adding new and enhanced features for product discovery and inspiration and making buying and selling more streamlined and intuitive.”

EBay reports that 40 per cent of new customers came via mobile devices last year and that mobile-enabled sales are growing rapidly, from $13 billion (£8bn) globally in 2012 to $22 billion last year. Calcott notes that the UK is one of eBay’s most advanced markets in terms of the proportion of sales transacted via mobile.

“Shopping is no longer about just online and the high street; today shopping is also a multi-screen experience,” she says. “You may start a purchase by browsing on your tablet at home, do some additional research on mobile but finish your purchase in store.”

The ICM research shows that about one-fifth of people (22 per cent) are buying more often on their mobiles compared with a year ago. However, the majority (73 per cent) believe there is no difference in their mobile spending habits while 5 per cent say they are buying less on their smartphones than they did last year.

The study also shows a discrepancy between people’s purchase intentions and their behaviour when they visit a brand’s mobile website. It shows a drop across most of the retailers in the sample from people who intended to buy when they visited the site versus those who completed the purchase.

Marks & Spencer has the worst conversion rate, according to the study, with 16 per cent of its mobile website visitors intending to purchase but only 9 per cent doing so. By contrast, all smartphone users who visit the Boots mobile website with an intention to buy (16 per cent) also complete the purchase.

“We can’t be sure that retailers are actually losing sales because consumers might be doing research on their mobiles when they’re out and about and then completing the purchase at another time,” suggests ICM’s Belnikoff.

“Brands have to ensure that they’re not losing sales and the challenge is closing the loop in the moment.”

Mobile marketing companies such as Weve are attempting to help retailers increase their mobile conversions by encouraging people to use their phones in physical retail settings. Weve, a joint venture set up byEE, O2 and Vodafone , is developing a range of mobile commerce solutions for different partners, including mobile wallets and location-based targeting services.

Earlier this year, food chain Eat became the first brand to trial Weve’s new loyalty app, Pouch , which stores loyalty cards, vouchers and branded content. The app also connects to in-store Bluetooth low-energy devices known as beacons so that retailers can target customers with messages in-store by sending push notifications to their mobile phones.

Sean O’Connell, director of product at Weve, believes that while ecommerce on smartphones is already well established, connecting the mobile and physical retail experiences will take longer to develop.

“We’ve found that putting a beacon into stores and making it do something is relatively easy,” he says. “Bringing that to life in a way that doesn’t annoy people and that has some intelligence in the targeting and messages it delivers is the challenge.

“At the moment, a lot of brands are trying lots of different things and learning that it’s not actually about the technology; it’s about the proposition and how it makes the customer experience better.”

via Apps falling behind mobile websites in rush to m-commerce | Trends | Marketing Week.

Source : http://www.ebusiness.fr/