Overview

This report covers a range of digital advertising topics based on a review of 2015, with an emphasis on Q4, mobile, and retail trends.

- Search engine spend, click-through-rates (CTR), and cost-per-click (CPC) across different regions, search engines, and devices.

- Display click-through-rates (CTR) and cost-per-thousand (CPM) globally and by platform.

- Deeper dive into Q4 advertising patterns for key US retailers.

Key Insights

- Global Paid Search growth showed signs of slowing compared to last year (Q4 2014 spend growth increased +12% YoY vs. +3% YoY in Q4 2015).

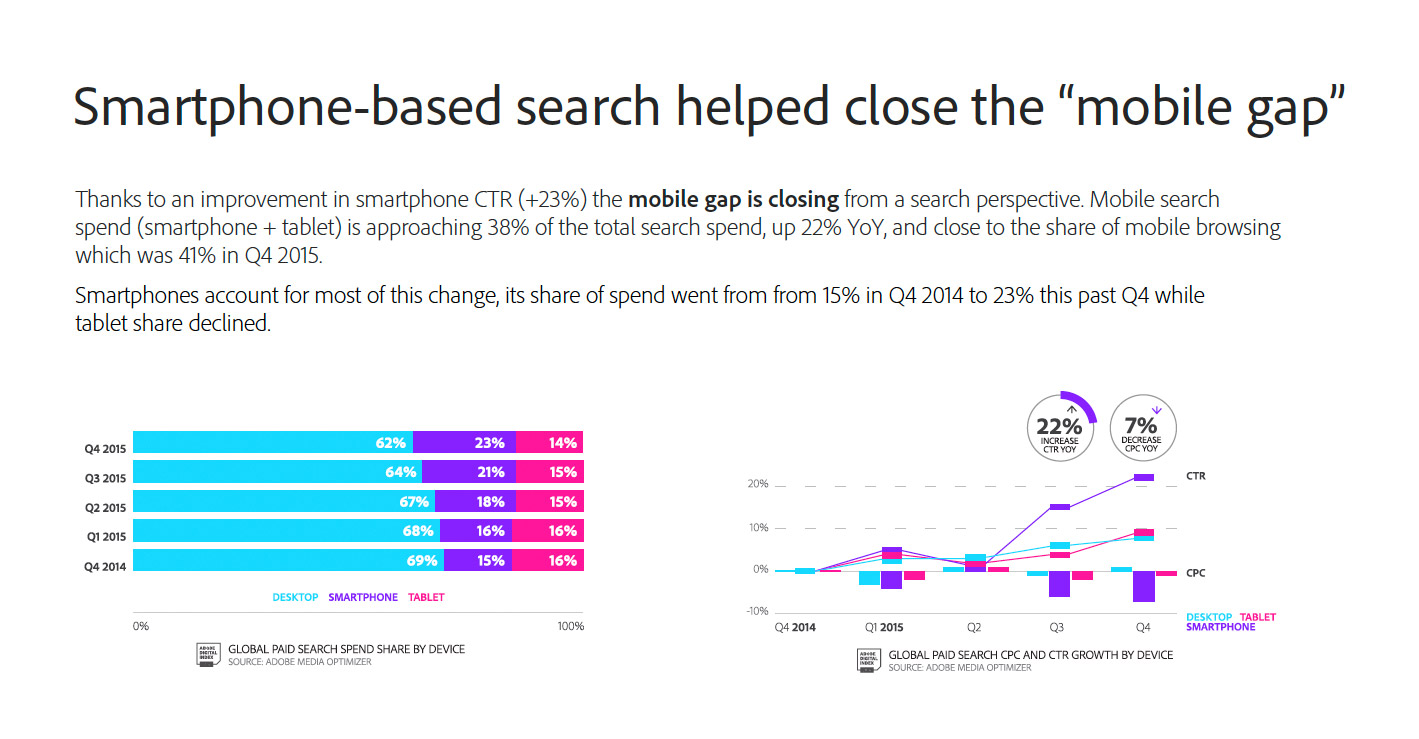

- Mobile spend (+23% YoY) helped close the “mobile gap” and increase mobile traffic (+35% YoY). A shift in spend to Google andBing product listing ads (PLAs) contributed to this increase beginning in Q3 2015.

- For US retailers during Thanksgiving Weekend 2015, Paid Search contributed 10% more revenue than direct traffic; paid search revenue also grew faster than revenue from direct traffic YoY (46% vs. 34%, respectively), and display saw the largest increase in revenue share throughout the entire holiday period.

- Google begins to close the display advertisement gap with Facebook.

Button Text