Le développement d’Internet et la numérisation ont engendré une révolution au sein des industries culturelles, en permettant à l’ensemble des internautes de participer à la création et au partage de biens et de services, en créant une rencontre entre producteurs et consommateurs, et en développant des nouveaux modes de création de valeur. Cette nouvelle approche des pratiques culturelles, fondée en grande partie sur le partage et l’essor des pratiques amateurs, fait toutefois disparaître les frontières, permet l’émergence de nouveaux acteurs et met fin de la domination économiques de vieux acteurs, faisant ainsi croire que cette numérisation tue les industries culturelles. Un rapport intitulé « The digital future of creative Europe », conduit par PwC Strategy& et réalisé en partenariat avec Google vient contredire ces suppositions.

Extraits du rapport

Digitization — the mass adoption of Internet-connected digital technologies and applications by consumers, enterprises, and governments — is a global phenomenon that touches every industry and nearly every consumer in the world. For every industry, digitization changes the way products are made, sold, and distributed, as well as how companies are managed, and how and with whom they compete. For many industries, digitization is completely revolutionizing the way companies interact with their customers. (…) This report was financed by Google Inc., and independently researched and written by Strategy&. It was first published by Booz & Company in 2013, and was thoroughly reviewed and updated in 2015.

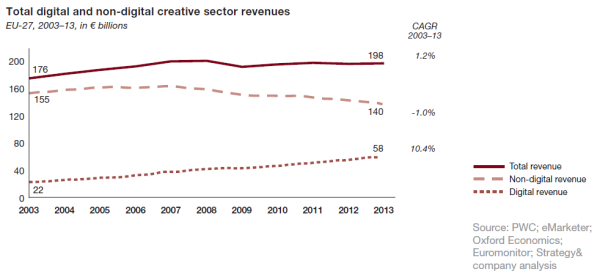

Mass adoption and high usage of the Internet have revolutionized the creative industries — but the biggest changes are yet to come. Overall, creative industry revenues in the EU-27, including digital and non-digital businesses, grew 1.2 percent compounded annually between 2003 and 2013, a total gain of 12 percent during the period, from €176.2 billion (US$190.5 billion) in 2003 to €197.7 billion in 2013.

All of the growth in the creative industries comes from digital. Creative sector revenues grew by €22 billion between 2003 and 2013. Non-digital revenue was down €14 billion during that period, to €140 billion, but the loss was offset by an increase of €36 billion in revenue from digital, to €58 billion. Consumer media usage continues to grow at a 4 percent annual clip, and across all the European countries we studied. With revenues increasing 12 percent compounded annually, digital gaming has outgrown all other sectors. The film and television sector shows a steady 3 percent increase, and book publishing comes in at 1 percent, right around the industry average. Periodicals and music have seen a 2 percent average decline, a trend that is continuing for periodicals, but that is slowly turning around for music, which has been growing slightly from its low point in 2010. (…)

Between 2003 and 2013, advertising- based revenues dropped by an average 1.5 percent annually, offset by 2 percent average annual growth in pay-based revenues such as subscriptions, streaming fees, and purchases of digital content. The overall number of jobs in the creative sector in Europe has been stable at 1.2 million. Gaming and film and television added jobs, while all other sectors shed jobs. Consumers continue to benefit from a greater variety of content available anytime and anywhere, generally at lower prices. Content creators are benefiting from easier access to distribution and more channels of communication with their audiences; the value they have captured seems to be stable, if not growing, in most sectors.

The transformation to digital has been challenging for many creative industry players, particularly those established players that focus on the packaging and distribution of content. They include many recorded music companies, which have found it difficult to transfer their capabilities and business models to the digital ecosystem. New entrants and local companies, however, have gained easier access to global consumers. The Internet has unearthed efficiencies in the creative industries, especially in manufacturing and distribution. Lower revenues are not necessarily a sign of weakness in these industries, as they are often accompanied by lower costs. Thus, the impact on profits varies significantly depending on each company’s cost structure.

The new ecosystem architecture now emerging as a result of digitization is presenting great opportunities. At the heart of the most successful business models is a seamless consumer experience, increasingly being created by new market entrants, often in partnership with incumbent players.